IRA Qualified Charitable Distributions

“As each one has received a gift, use it to serve one another as good stewards of God’s varied grace” (1 Pt 4:10)

Support your parish or a ministry that is meaningful to you by making a qualified distribution from your IRA.

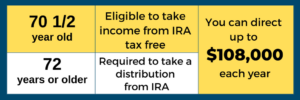

For individuals who are age 70 1/2 years and older, you can give any amount (up to a maximum of $108,000) per year from your IRA directly to the Diocese of Kansas City-St. Joseph without having to pay income taxes on the money. Gifts of any value ($108,000 or less) are eligible for this benefit, and you can feel good knowing you are making a difference for the Catholic Church.

So, if you are able, why not use your IRA to support your Catholic community?

- Beginning in the year you turn age 73, you can use your gift to satisfy all or part of your required minimum distribution (RMD).

- You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions.

- We must receive your gift by December 31 for your donation to qualify this year.

- Contributions must be made from traditional IRAs.

- Distributions must be transferred directly from your IRA account to qualified charity.

Tax Treatment

The tax treatment for an IRA QCD may make it possible for you to make a larger gift to your chosen ministry.

- IRA QCDs are excluded from taxable income.

- Taxpayers who do not itemize benefit most from an IRA QCD since they do not receive a tax benefit for charitable gifts.

- You can give up to $108,000 per year.

- Taxpayers who’ve reached the limit for charitable giving (usually 60% of adjusted gross income) can give more – up to the IRA limit.

- Your QCD can count towards your required minimum distribution (RMD). Contact your IRA administrator for the amount of your RMD.

Withdrawals from other qualified retirement plans (e.g. 401(k)s) are treated differently. The withdrawal may be eligible for a deduction, if you can itemize, but it also creates taxable income.

Next Steps

The diocese processes IRA distributions as a service to our parishes and ministries.

- Download the 2025 IRA Qualified Charitable Distribution Request Form.

- Send the form to your IRA administrator with instructions to send the distribution directly to the diocese. Please email a copy to Theresa Schuman at the Office of Stewardship & Development or fax 816-756-5089.

- Contact the Office of Stewardship and Development at (816) 714-2396 if you have questions or need more information.

- The diocese will honor your gift designation as you have indicated on the form.

It is critical to let us know of your gift by sending the form to us because many popular retirement plan administrators assume no obligation to notify a charity of your designation.