Gifts of Grain or Livestock

“And some seed fell on rich soil and produced fruit. It came up and grew and yielded thirty, sixty, and a hundredfold.” Mark 4:8

Help your Parish or favorite Ministry with a Gift of Grain or Livestock

Cash basis farmers who harvest crops in the fall and make plans for spring planting may find that making a charitable gift is an especially effective way to “share the harvest.”

How to donate your grain

- Contact the Office of Stewardship and Development at (816) 714-2396. We can provide the necessary forms and information for your grain elevator to directly transfer ownership to the diocese prior to sale to ensure favorable tax treatment.

- Download the Deed of Gift form below.

- When the grain is delivered to the elevator, give them the Gift of Grain form showing our contact information, so that we can take responsibility for the ultimate sale of the grain.

- The diocese will receive and own the grain only for a very short time before we sell it for as high a price as possible.

- The diocese forwards the proceeds to the parish, school or ministry you designated in the Gift of Grain form.

As with all charity and tax planning, you should consult your own financial and legal advisers about your personal tax and financial situation—this guidance is not meant to replace your advisers who know your entire financial picture.

‘Can’t I just sell my grain/livestock myself and donate the funds to my parish?’

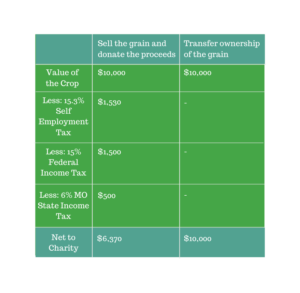

This is a possibility, however, similar to donating stocks/securities, doing so can open you up to paying taxes on this sale, and seeing your parish or preferred ministry receiving less. For example, let’s look at a potential $10,000 gift of grain in the chart below:

Tax Treatment

The example below illustrates that for many farmers a gift of grain can increase the impact of their giving. The tax treatment can reduce adjusted gross income, help reduce the basis on which tax is assessed, and allow larger giving not limited to 60% of adjusted gross income. Plus, there is no need to itemize to get the benefit.

- The value of the contributed grain is excluded from income.

- In many cases, the donated grain lowers the income subject to self-employment tax.

Use your donation of Grain or Livestock to open a Donor-Advised-Fund (DAF)?

Use your donation of Grain or Livestock to open a Donor-Advised-Fund (DAF)?

If you’d like to have your gift of Grain or Livestock to pay for an ongoing or recurring pledge, opening a Donor Advised Fund (DAF) with Catholic Community Foundation (CCF) could be for you. Please click the link above to see if the option might be right for you.