2021 Bishop’s Report to the Diocese

Dear Brothers and Sisters in Christ,

I appreciate this opportunity, along with our Diocesan Finance Officer, Angela Laville, to share directly with you details of the Diocesan Financial Report, our financial stewardship of the resources provided by your donations and other gifts supporting the work, ministry and mission of the Church entrusted to us by Jesus Christ. Your gifts, sacrificial offerings and tithes enable our diocese to sustain and appropriately grow the services and ministries that support and enable our parishes, schools and other institutions to be all they are meant to be.

The life and growth of the Church in northern and western Missouri form our identity together as the family of God. Additionally, because of these financial gifts, together we are also able to specifically fund certain corporal and spiritual works of mercy through grants and other means of reaching specific needs. All these actions combined enable me to more fully and directly fulfill my office as your shepherd as we follow Jesus as missionary disciples.

In my travels throughout the cities, towns, and all the corners of our diocese, I continue to see the rich blessings God showers upon us as well as our Catholic faith expressed in you, His children. In spite of the challenges that the pandemic has placed upon us, sacraments continue to be celebrated with faith and joy; teaching, sharing and handing on the faith to both our young and not-so-young continues in so many beautiful ways; works of Christian charity and mercy are extended in hope. We are blessed indeed.

Our 2022 Annual Catholic Appeal is under way and your contribution remains essential to the mission and ministry of the Church. Your participation at some level is itself an expression of faith.

As we look ahead to the season of Lent, let us personally consider what difference Jesus Christ makes in our lives and make a choice to live fully for him who gave himself for us. I offer my own thanks to each of you who play a part in renewing the Church which Jesus created and to which we belong, that there be life in abundance. Thank you for your belief and faith, for your witness to your baptism, for your generous heart. Thank you for your generosity in giving back to God from the various blessings God has given you; for indeed, “the Love of Christ urges us on!” (2 Cor 5:14).

Gratefully yours in Christ,

+ Bishop James V. Johnston, Jr.

Letter from the Diocesan Finance Officer

Stewardship and accountability for the financial resources of the Diocese of Kansas City-St. Joseph is critical to the mission of using resources wisely. With that, we must present the financial status of the components of the administration of the diocese for the fiscal year ending June 30, 2021. The information disclosed covers the following areas of the diocese.

- Diocesan Chancery Operation (DCO) – includes administrative functions, ministries and programs operated at the Catholic Chancery (at the Catholic Center), as well as our campus ministry locations.

- Diocesan Deposit and Loan Fund (DLF) – is a segregated trust that contains deposits of parishes and schools ‘in trust’ and offers loans to parishes and schools for new construction and major renovation. The Trust is overseen by a seven-member Board of Trustees.

- Diocesan Insurance Operation (DIO) – represents the Diocesan self-insurance fund for property and casualty insurance along with the lay and clergy benefit programs.

The disclosure of the financial information represents the commitment to transparency regarding the source of funds along with the use of those funds. Bishop Johnston, Diocesan Leadership, the Diocesan Finance Council and the staff of the Diocesan Finance Office wish for all to be aware of the overall financial condition of the diocese.

Diocesan Chancery Operation (DCO)

Catholic Diocese of Kansas City-St. Joseph

Chancery Operation Statements of Financial Position

Years Ended June 30, 2021 and 2020

| 2021 Total | 2020 Total | ||

ASSETS |

|||

| Cash & Cash Equivalents | $22,761,003 | S18,239,214 | |

| Loans & Accounts Receivable | $5,825,910 | $5,783,450 | |

| Pledges Receivable-Annual Catholic Appeal | $118,588 | $114,751 | |

| Land, Buildings & Equipment | $9,664,938 | $9,998,635 | |

| Beneficial Interest in Others | $778,436 | $610,698 | |

| Investments, At Market | $3,834,646 | $3,010,496 | |

| Total Assets | $42,983,521 | $37,757,244 | |

LIABILITIES |

|||

| Accounts Payable | $762,793 | $782,032 | |

| Notes Payable | $4,027,191 | $4,218,304 | |

| Other Short-Term Deposits | $1,647,796 | $1,570,580 | |

| Annuities Payable | $827,547 | $727,516 | |

| Long-Term Deposits Payable: | |||

| Diocesan Insurance Reserves | $5,963,455 | $2,343,063 | |

| Retired Priests Benefit Obligations | $9,248,672 | $9,926,384 | |

| Deferred Revenue | $311,733 | $61,463 | |

| Total Liabilities | $22,789,187 | $19,629,342 | |

NET ASSETS |

|||

| Without Donor Restrictions | |||

| Designated Funds | $4,650,205 | $4,620,396 | |

| Designated for Annuities | ($15,856) | ($62,372) | |

| Expended for Plant | $4,613,953 | $4,756,537 | |

| Undesignated Reserves | $1,895,107 | $460,681 | |

| Total Net Assets Without Donor Restrictions | $11,143,409 | $9,775,242 | |

| With Donor Restrictions: | |||

| Other | $665,258 | $665,258 | |

| Endowments | $8,385,667 | $7,687,402 | |

| Total Net Assets with Donor Restrictions | $9,050,925 | $8,352,660 | |

| Total Net Assets | $20,194,334 | $18,127,902 | |

| Total Liabilities & Net Assets | $42,983,521 | $37,757,244 |

The above information is from the 2020/2021 annual audit report prepared by the accounting firm RSM US. The audit resulted in a “clean opinion” which means that there were no qualifications and the financial statements “represent fairly, in all material respects, the financial position of the Catholic Diocese of Kansas City-St. Joseph Chancery Operation as of June 30, 2021 and June 30, 2020, and…are in accordance with the accounting principles generally accepted in the U.S.”. In addition, the audit firm indicated that there were not any internal control weaknesses identified within the scope of the audit. The Diocesan Finance Council reviewed and recommended approval of the audit at the meeting on October 25, 2021. This recommendation was subsequently approved and accepted by Bishop Johnston.

The below information is based on the DCO’s Statement of Financial Position presented above.

Total Net Assets Without Donor Restrictions increased by approximately $1.4 million to $11.1 million. This variance is primarily included in the Undesignated Portion of Net Assets Without Donor Restricts and is partially attributable to a reduction in the liability for the accrued benefit obligation for health care and long-term care for our retired priests. The liability was reduced by $0.7 million due to an actuarial gain of $0.8 million.

The mortgage on the Catholic Center was reduced by $200,000, ending the year with a balance of $4.0 million. The original mortgage on the Catholic Center in October, 2010 was $7.0 million.

Operationally, the DCO ended the fiscal year with a surplus of $2.1 million. There are various aspects to this improvement. Income received from the Annual Catholic Appeal increased to $2.0 million from $1.85 million in the previous fiscal year. In addition, as the faithful community continue to recognize the importance of vocation awareness and the cost of seminarian education (undergraduate, pre-theology and theology programs), the Tomorrow’s Priests special collection increased from $66,000 to $200,000.

The majority of the surplus is driven by the fact that the 2020/2021 fiscal year included a full year of Cathedraticum assessment and insurance premiums from the parishes and schools while the 2019/2020 fiscal year only included ten months. This resulted from the fact that in the 2019/2020 fiscal year, the DCO implemented a Parish/School Plan to assist during the Covid-19 pandemic. This plan forgave two months of the Cathedraticum assessment for parishes and 25% of property and casualty premiums for the same two months for parishes and schools.

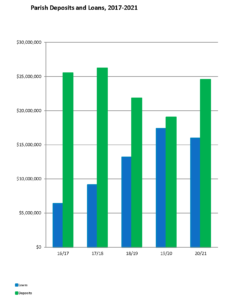

Diocesan Deposit and Loan Fund (DLF)

Catholic Diocese of Kansas City-St. Joseph

Deposit and Loan Fund Statements of Financial Position

Years Ended June 30, 2021 and 2020

| 2021 Total | 2020 Total | ||

ASSETS |

|||

| Cash & Cash Equivalents | $1,953,791 | $2,650,695 | |

| Loans & Accounts Receivable | $18,956,033 | $20,968,265 | |

| Investments | $37,362,826 | $20,365,350 | |

| Total Assets | $58,272,650 | $43,984,310 | |

LIABILITIES |

|||

| Parish Deposits | $24,554,355 | $19,054,730 | |

| School Deposits | $1,128,531 | $1,173,347 | |

| Other Short Term Deposits | $18,584,498 | $12,507,003 | |

| Long Term Deposits Payable: | |||

| Cemetery Perpetual Care Funds | $6,625,407 | $6,591,928 | |

| Total Liabilities | $50,892,791 | $39,327,008 | |

NET ASSETS |

|||

| Without Donor Restrictions | |||

| Designated Funds | $1,547,972 | $1,547,972 | |

| Undesignated Funds | $4,235,544 | $1,562,442 | |

| Total Unrestricted Net Assets | $5,783,516 | $3,110,414 | |

| With Donor Restrictions | |||

| Endowments | $1,596,343 | $1,546,888 | |

| Total Restricted Net Assets | $1,596,343 | $1,546,888 | |

| Total Net Assets | $7,379,859 | $4,657,302 | |

| Total Liabilities & Net Assets | $58,272,650 | $43,984,310 |

The Board of Trustees of the Diocesan Deposit and Loan Fund approved the Fund’s audit on October 28, 2021. The audit of this Fund was performed by RSM US and received an unqualified opinion and represents the fifth full year of operation as a separate trust. The Statement of Financial Position demonstrates growth from the prior year in total assets of $14.3 million to $58.3 million. Of this amount, $39.3 million is held in cash and investments to address future withdrawals and loans. Total Net Assets increased in the 2020/2021 fiscal year from $2.7 million to $7.4 million. The amount of net deposits as of June 30, 2021, in conjunction with internal projections of deposits, withdrawals, loans and principal paybacks through the end of the calendar year, indicate adequate capacity to handle anticipated loans and withdrawals. While there is an increase in impending construction and renovation projects, the Fund balances are predicted to be sufficient.

Diocesan Insurance Operation (DIO)

Catholic Diocese of Kansas City-St. Joseph

Diocesan Insurance Office Statements of Financial Position

Years Ended June 30, 2021 and 2020

| 2021 | 2020 | ||

ASSETS |

|||

| Current Assets: | |||

| Cash | $53,957 | $33,289 | |

| Prepaid Premiums | $286,716 | $265,126 | |

| Accounts Receivable | $98,441 | $95,176 | |

| Total current assets | $439,114 | $393,591 | |

| Investments | |||

| Deposits with Catholic Diocese of Kansas City-St. Joseph | $5,963,455 | $2,343,063 | |

| Investments, National Catholic Risk Retention Group Stock | $1,693 | $1,693 | |

| $5,965,148 | $2,344,756 | ||

| Total Assets | $6,404,262 | $2,738,347 | |

LIABILITIES |

|||

| Current Liabilities | |||

| Auto premium reserve | $99,525 | $98,202 | |

| Claims & expenses payable – Property & Casualty | $2,597,117 | $1,081,922 | |

| Claims & expenses payable – Self Funded Health Insurance | $500,393 | $761,042 | |

| Total Current Liabilities | $3,197,035 | $1,941,166 | |

| Claims Incurred But Not Reported | $1,244,681 | $1,608,034 | |

| Total Long-term Liabilities | $1,244,681 | $1,608,034 | |

| Net Assets (Deficit) Without Donor Restrictions | $1,962,546 | ($810,853) | |

| Total Liabilities & Net (Deficit) | $6,404,262 | $2,738,347 |

The Diocesan Insurance Operation is reviewed by RSM US each year. The scope of a review is substantially less in scope than an audit. A review includes applying analytical procedures to management’s financial data and making inquiries of management, but does not result in an opinion regarding the financial statements as a whole. The Diocesan Finance Council reviewed this report at its meeting on November 22, 2021.

On January 1, 1975, the diocese established a self-insurance program for property and casualty insurance coverages. Under this program, the diocese self-insures the property and casualty coverages (except for boiler insurance and worker’s compensation insurance) for all Diocesan parishes, schools, early childhood centers, Catholic Cemeteries Association and Catholic Charities of Kansas City-St. Joseph. The self-insurance programs provide coverage for buildings, machinery and equipment, boiler, workers’ compensation, automobile, student accident, comprehensive general liability, fiduciary liability, professional liability, sexual misconduct liability and cyber liability. The program includes a limit on each claim payable by the diocese. Claims in excess of the self-insured retention are insured by licensed insurance carriers. Under the program, the diocese contracts for the administration of claims, appraisals, and loss control and prevention services. The Diocesan Insurance Office coordinates the placement of coverage and the payment of claims and premiums with insurance companies and service providers.

In addition to the property and casualty coverages, the Diocesan Benefits Office (as part of the Office of Human Resources) administers the clergy and lay employee benefit programs, which include pension, life insurance, short-term disability, health care insurance, voluntary dental care, voluntary supplemental life insurance, flexible spending accounts, health savings accounts, long-term care (clergy) and supplemental medical reimbursement (clergy). Please note that the actual pension plans for the Diocesan priests and the lay employees of the parishes, schools and other entities are contained in two separate trusts overseen by two different boards.

Premiums for the self-insurance property and casualty coverages are based on an exposure assessment for the specific line of coverage such as the appraised value of structures and contents for property coverage. Premiums are collected by the DIO and used to pay claims as they are incurred. Premiums for insured coverages are collected by the DIO from all the entities of the Catholic Diocese of Kansas City-St. Joseph, Catholic Cemeteries Associated of Kansas City-St. Joseph, and Catholic Charities of Kansas City-St. Joseph.

The DIO Statement of Financial Position presented in this article demonstrates that net assets is $2.0 million at the end of fiscal year 2020/2021. The DIO operations resulted in a surplus for 2020/2021 of $2.7 million. This is the seventh consecutive year of a surplus which is primarily a product of positive claims experience. A plan, approved by the Diocesan Finance Council in January, 2014, has enabled the net asset amount to increase by approximately $18.0 million from ($15.0 million) in 2013/2014 to $2.8 million in 2020/2021. The Diocesan Finance Office and the DIO continue to monitor and follow the plan set forth by the Diocesan Finance Council.

CLOSING

In summary, stewardship and accountability for the financial resources of the various areas of the Diocese of Kansas City-St. Joseph are functioning with integrity. The DCO continues to operate with a surplus while achieving goals toward the Mission. The DLF effectively addresses the savings and loan needs of parishes and the DIO has progressed with the plan set forth by the Diocesan Finance Council and continues to implement short and long term strategies for cost-effective healthcare for lay employees and clergy. The Mutually Shared Vision of One Family: Restored in Christ, Equipped for Mission remains a priority to move our diocese forward over the next five years.

Finally, Bishop Johnston is extremely grateful to all who have continued stewardship of time, talent and treasure. His gratitude extends beyond the giving to the DCO to your generosity to parishes, schools and Catholic Charities.

If you have questions or wish to discuss the information contained in this report, please contact me at (816) 714-2319 or email me at laville@diocesekcsj.org. The complete audits for the DCO and the DLO along with the review for the DIO will be published on the Diocesan website here.

We understand that the past year has been challenging and we appreciate your continued support. It is our hope that this report demonstrates that your support is valuable in many aspects for the Diocese of Kansas City-St. Joseph.

Angela Laville

Diocesan Finance Officer